Carlyle’s Global Private Equity investment team has actively invested in the Aerospace and Government Services industries for over three decades. While trends in the sector continue to evolve, our investment team remains focused on finding opportunities to leverage our deep industry expertise, vast global network, and differentiated platform. We seek to partner with leading companies and management teams to create value and achieve growth through refinement of strategies, increased investment, and operational improvement.

Sector Strategy and Approach

Our experienced global investment team has a history across sub-sectors and through cycles. We target opportunities that benefit from identified trends within each sub-sector, anchored by differentiated capabilities, intellectual property, and strong market positions. We seek to partner with market leaders of scale, as well as companies with significant growth potential, that we believe will benefit from our global investment platform and deep industry expertise.

We are highly selective, yet flexible on investment size (from $50 million to more than $1 billion), form (minority or majority), and growth stage of our partnerships, which gives us the opportunity to partner with great management teams regardless of their company’s size or current capital needs.

Working with the management teams of our portfolio companies, Carlyle excels in driving performance through multiple levers of value creation, including international expansion, new product development, M&A, and strategic positioning. Our investment strategy is underpinned by several key investment themes within the Aerospace and Government Services industries, including:

- Consolidation to strengthen the supply chain and support post-pandemic recovery

- Growth in aftermarket and development of cost savings solutions

- Increased focus on sustainability

- Priority to support service life extensions through sustainment, modernization, and aftermarket demand

- Opportunities for increased effectiveness and efficiencies through IT modernization, digital transformation, business process outsourcing, and managed services

- Growing complexity and proliferation of cybersecurity threats

- Emergence of artificial intelligence, machine learning, and other advanced capabilities to generate actionable insights and enable real-time decision-making

Aerospace & Government Services Portfolio Companies

Carlyle strives to be the partner of choice for founders and management teams looking to improve their market position and accelerate growth. We leverage the significant resources and domain expertise of our global platform to support the execution of a shared strategic vision.

Global Aerospace & Government Services Team

Our experienced global team includes dedicated investment professionals based in the Americas and Europe who have extensive experience working with companies in both developed and emerging markets. We also work closely with a network of current and former industry and government leaders with extensive knowledge and significant subject-matter expertise to help build and execute upon unique value creation plans for Carlyle’s portfolio companies.

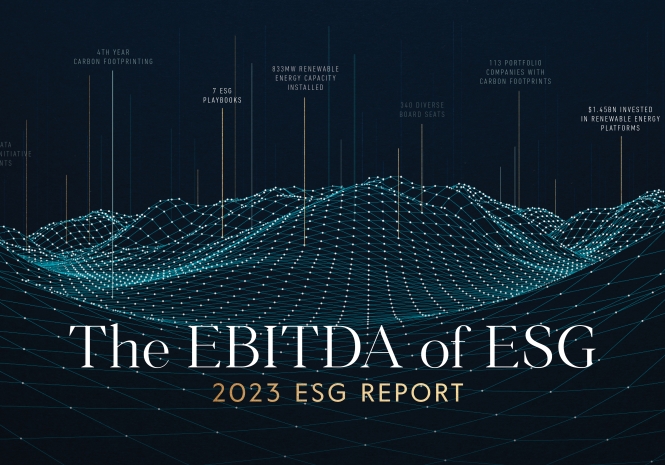

EBITDA OF ESG

We are pleased to share this year’s ESG report, entitled “The EBITDA of ESG” to reinforce our belief that integrating ESG factors into our investment processes provides an additive lens that we believe can provide opportunities for our portfolio companies to drive revenues, reduce costs, secure more efficient financing, and strengthen their competitive positioning.