Carlyle’s Global Private Equity Technology investment team partners with strong founders and management teams at companies across various stages of growth, ranging from incumbent market leaders to disruptive businesses that are earlier in their journey.

We seek opportunities to add differentiated value through our global platform, sector expertise, history of driving growth across a range of business models, and experience supporting technology companies across various sub-sectors, geographies, and economic conditions. We leverage our collective resources to develop and execute bespoke value creation plans tailored to each company’s unique opportunity set.

Sector Strategy and Approach

Our deep sector expertise allows us to identify opportunities to partner with companies that apply technology solutions across other industries including financial services, healthcare, consumer, industrial, aerospace & defense, and energy.

Our global team also has expertise in enterprise IT architectures and cloud computing, infrastructure and consumer software, data analytics, tech-enabled business services, hardware technology, mobility, the internet of things (IoT), and cybersecurity.

Working with the executive teams of our portfolio companies, Carlyle excels in driving performance through multiple levers of value creation, including international expansion, new product development, M&A, and strategic positioning strategies. We focus on a number of themes that inform our technology investment strategy, including:

- The rise of vertical application software across sectors.

- Disruption driven by horizontal application software in large and growing markets.

- Increasing focus on infrastructure software and security.

- Growth of communications infrastructure and gaming.

- Digital transformation.

Technology Portfolio Companies

Carlyle strives to be the partner of choice for founders and management teams focused on global, investment-led growth and commercial excellence opportunities.

Global Technology Team

Our global Technology team consists of investment professionals in offices across the U.S., Asia, and Europe. We also consult with several our Operating Executives and Senior Advisors who bring significant subject-matter expertise and relationships to Carlyle’s partnerships.

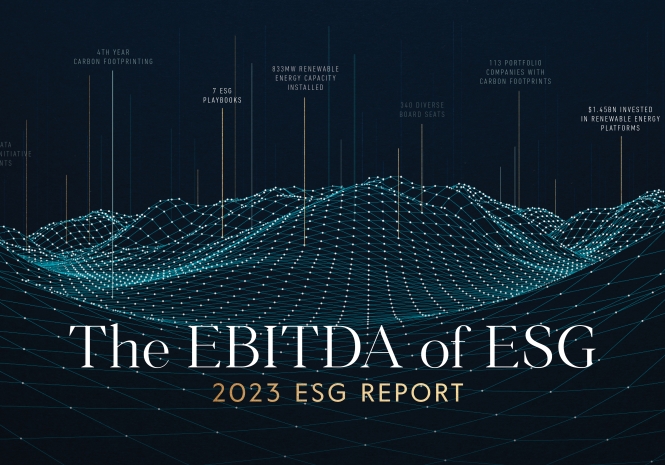

EBITDA OF ESG

We are pleased to share this year’s ESG report, entitled “The EBITDA of ESG” to reinforce our belief that integrating ESG factors into our investment processes provides an additive lens that we believe can provide opportunities for our portfolio companies to drive revenues, reduce costs, secure more efficient financing, and strengthen their competitive positioning.